Our Financial Future

Consultation has concluded

Investigation into financial sustainability

Between August and October 2023 Council engaged with our community as part of an investigation into whether an application would be made to IPART for a Special Rate Variation.

At the Ordinary Council Meeting on 21 November 2023 Council resolved to apply for a Special Rate Variation of 42.7% cumulative over three years.

THIS PAGE HAS BEEN RETAINED FOR COMMUNITY REFERENCE AS TO HOW THAT DECISION WAS REACHED IN NOVEMBER

------

Council is facing significant financial challenges over the next 10 years if we are going to meet the community expectations on service delivery and maintain or improve major assets like roads, bridges and community facilities.

Current estimates are the General Fund, where your rates are paid, will be in deficit totalling $103 million over the coming decade.

Since 2019 Council has been working on a financial sustainability program that has made the service delivery more efficient and reduced costs, but it has not closed the gap between income and expenses. Council is now forced to take urgent action and is considering having to make the difficult decision to apply to the Independent Pricing and Regulatory Tribunal (IPART) for a Special Rate Variation (SRV) that could take effect from July 2024.

What has caused the financial issues?

Many factors have contributed to making Council’s financial position unsustainable.

- Rising cost of materials, labour and contractors.

- Forecast loan borrowings to help fund the deficit and backlog of asset maintenance required, will now be impacted by rising interest rates.

- Rate Pegging – the NSW Government restricts how much Councils can typically increase rates by, and in recent years rate rises haven’t kept up with inflation.

- Millions in grant funded improvements post fires and floods means we need to put more away each year to save for maintenance and renewal – depreciation costs.

- Community expectations are that maintenance and replacement of assets like roads, bridges and community facilities should be improved on current levels, requiring greater investment.

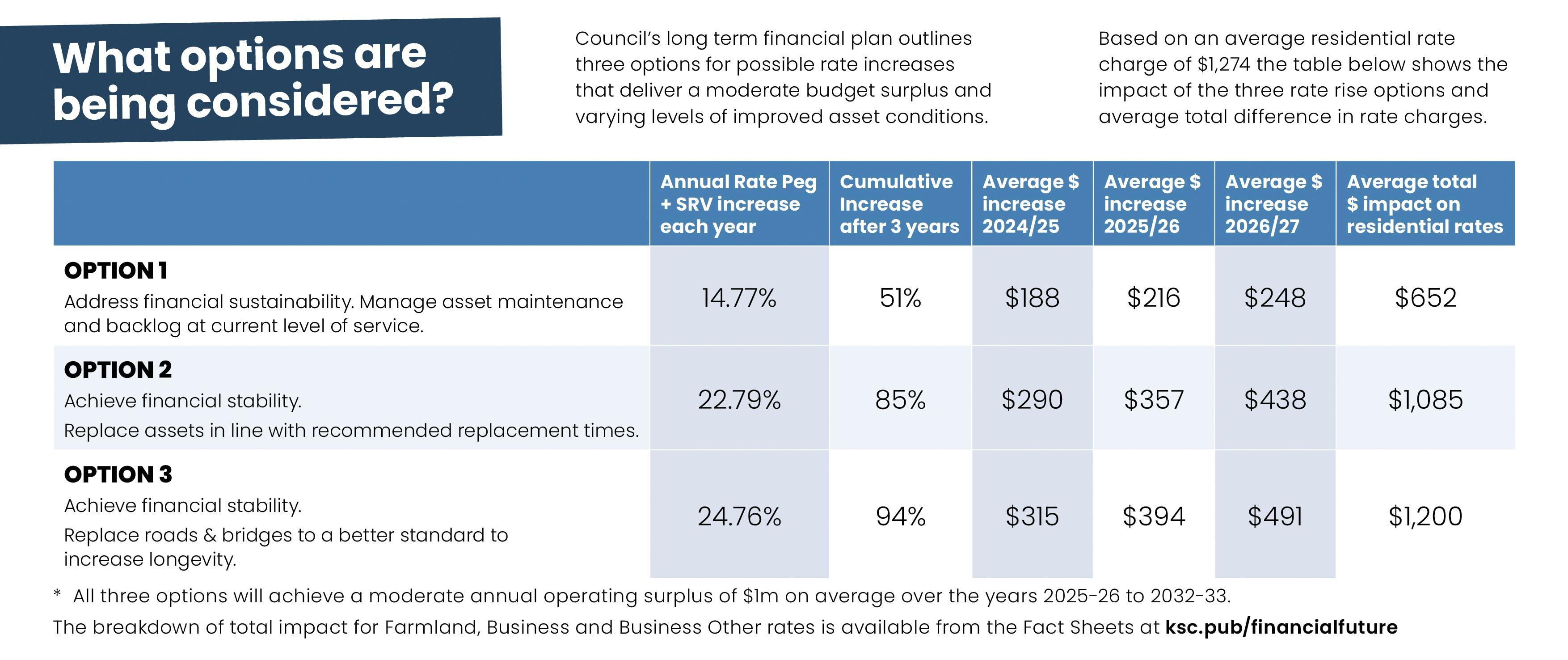

What options are being considered?

Council’s long term financial plan, adopted in June 2023, outlines three options for possible rate increases that deliver varying levels of improved financial position. All three options include a rate increase each year for three years between 2024 and 2026, which would then be permanently retained as the rating level. The increase would only apply to the General Fund (property rate) on your rates notice, and not the total bill amount.

Check Fact Sheet 3 to see the average impact on all rating categories.

More information:

- What is Council doing to reduce costs?

- What caused the financial issues?

- The impact on all rating categories

- Rising property values and rates

- What changes with higher rates?

- Cost shifting

Common Questions - the answers to all the questions the community have raised.

Special Rate Variation Calculator

Read stories published about the investigation

Have a say:

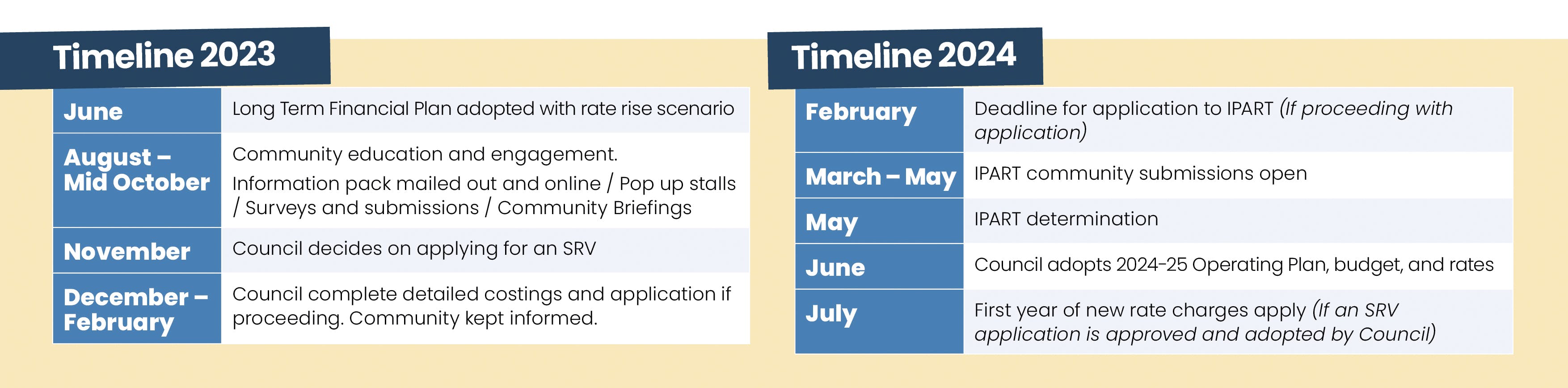

Council will decide at the November 2023 meeting whether to apply to Independent Pricing and Regulatory Tribunal (IPART) for the SRV and if so, which option to apply for.

Read the background information and have your say by completing the survey and indicating your rating preferences or making a submission.

Visit Council staff at a pop-up stall to ask questions and have a say.

Book a Community Briefing. Your club or community group can invite Council staff to make a presentation and answer questions at your next meeting through September and October.

Next Steps:

Community education and engagement commences in August and closes on Sunday 29 October. A report will go to the November Council meeting to review the research, financial modelling and community feedback.

If Council decide to make an application for an SRV the application will be submitted in February 2024. IPART accept submissions from the community ahead of a determination expected in May 2024.

Long term financial sustainability is not an easy subject and Council understand that in challenging economic times the community are likely to have many questions. Some of the most common questions have been reviewed and published throughout the engagement, available on the right-hand side of this page.

Submit your questions not already covered and we'll respond to you and update the site.

* Note: Questions are presented unedited and as provided by community representatives.